Are you looking for the best apps to send money to Nigeria from the UK? Read further down this article as Billz makes a list of the best iOS and Android apps to send money internationally.

Sending money to loved ones in Nigeria from the UK can be a hassle. Traditional methods, like bank transfers, can be slow, expensive, and inconvenient. Luckily, the rise of apps to send money to Nigeria from the UK has revolutionized the process, making it faster, simpler, and more affordable.

So, whether you’re supporting your family, contributing to a special occasion, or simply sharing your financial blessings, these apps offer a convenient and efficient solution. But with so many options available, choosing the right one can be overwhelming.

This guide explores the top 4 apps to send international payments from the UK, highlighting their features, fees, and ease of use to help you make an informed decision.

Top 4 Apps To Send Money To Nigeria From the UK (For iOS and Android)

Contents

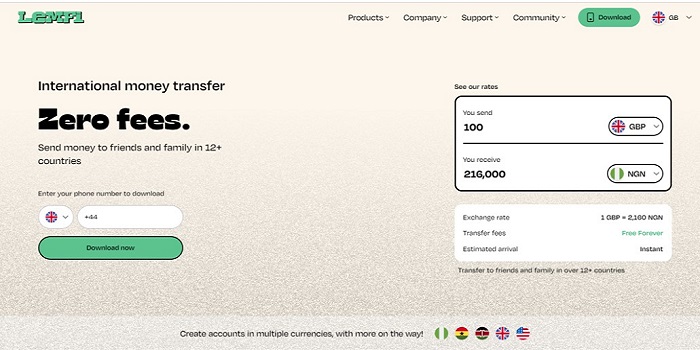

1. LemFi

How it works: Free international transfers, a user-friendly app, and the ability to send/receive money from various countries (including Nigeria, the UK, the US, and Canada). There are no signup fees, transaction fees, or exchange rate markups.

Requirements: valid ID, recipient’s details (bank/mobile money).

Efficiency: Transfers are mostly instant, but may take 2–3 business days sometimes.

Download:

iOS:

,Android:

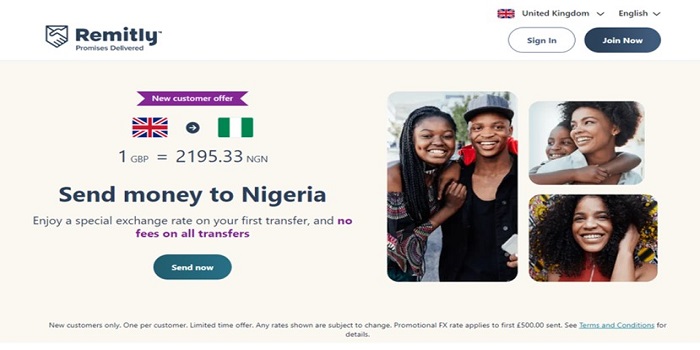

2. Remitly

How it works: Remitly boasts a user-friendly interface, allowing you to send money through their app or website. Simply enter the recipient’s details, choose a delivery method (bank deposit, mobile money, or cash pickup), and select your payment method (debit/credit card, bank transfer).

Remitly offers competitive exchange rates and transparent fees upfront, so you know exactly what you’re paying.

Requirements: You’ll need a valid ID and the recipient’s bank account details or mobile money number.

Efficiency: Remitly delivers quickly, often within minutes, for cash pickups and mobile money transfers. Bank deposits may take 1-3 business days.

Download:

iOS:

Android:

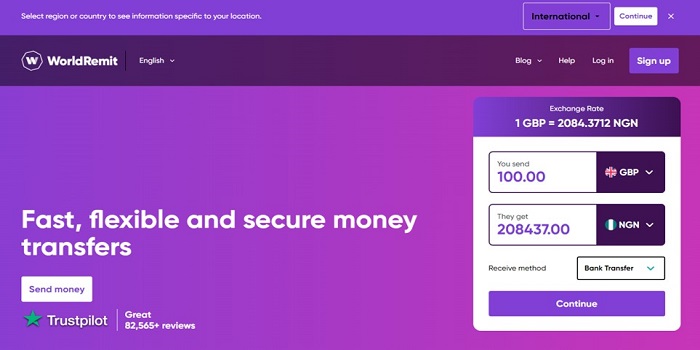

3. WorldRemit

How it works: WorldRemit offers a similar experience to Remitly, with a user-friendly app and website. They pride themselves on fast, secure transfers, and transparent fees.

Choose your recipient’s location, select your payment method, and enter the amount you want to send. You can even track your transfer in real time.

Requirements: A valid ID and the recipient’s bank details or mobile money number are required.

Efficiency: WorldRemit offers fast transfers, with some reaching recipients within minutes. Bank deposits may take longer, depending on the receiving bank.

Download:

iOS:

Android:

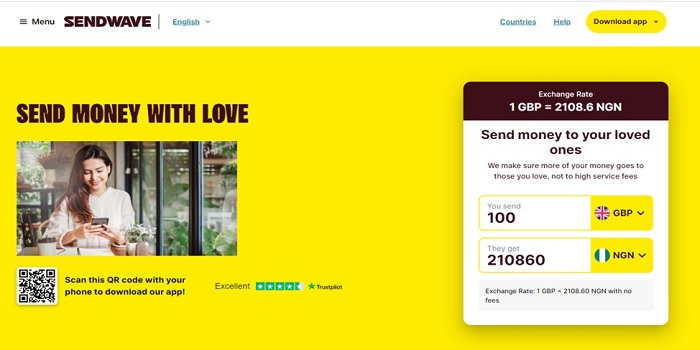

4. Sendwave

How it works: Sendwave focuses on mobile money transfers directly to Nigerian wallets. Their app is simple and efficient, allowing you to send money with just a few taps. You can also track your transfers in real time and receive notifications when the money arrives.

Requirements: You’ll need a valid ID and the recipient’s mobile money number.

Efficiency: Sendwave excels in speed, with most transfers reaching recipients within minutes.

Download:

iOS:

Android:

Choosing the Right App to Send Money to Nigeria From the UK

With these top 5 apps under your belt, choosing the right one depends on your specific needs and priorities. Consider the following factors:

Transfer Speed:

If speed is essential, prioritize apps like Sendwave for direct mobile money transfers or Remitly for fast cash pickups.

Fees:

Compare fees carefully, keeping in mind both fixed charges and exchange rate margins. LemFi and TransferGo are known for their competitive rates, while Remitly and WorldRemit offer various fee structures depending on transfer speed and amount.

Delivery Method:

Choose an app offering the recipient’s preferred method, whether it’s bank deposit, mobile money, or cash pickup.

Convenience:

Consider the app’s user-friendliness, features like real-time tracking, and customer support availability. Remitly and WorldRemit offer user-friendly interfaces and extensive customer support, while Sendwave boasts a sleek, mobile-focused experience.

Special Features:

Some apps, allow scheduling transfers, while others, like Remitly, offer promotions and referral bonuses. Choose an app with features that add value to your specific needs.

Remember, sending money to Nigeria from the UK, doesn’t have to be a chore. By utilizing these convenient and secure apps, you can ensure your loved ones receive your support quickly, reliably, and at an affordable cost.

Conclusion

Compare rates and fees across different apps before committing. Currency exchange rates fluctuate, so checking regularly can save you money. You can also look out for promotions and referral bonuses offered by some of these apps.

Ensure you understand the recipient’s preferred method of receiving money before sending. Be cautious of scams, and only use reputable, regulated apps.

By following these tips and choosing the app that best meets your needs, you can experience the ease and efficiency of sending money to Nigeria from the UK, ensuring your loved ones receive your support seamlessly and promptly.